Environmental, Social, and Governance (ESG) requirements are constantly evolving, and board members need to keep themselves up to date. Boards Impact Forum provided insights into this critical area via a webinar that included two experienced board professionals and two experts in the fields of sustainability reporting and finance.

Speakers Harri-Pekka Kaukkonen (Chair, YIT, Lindstrom Group, Gubbe Sydänystävä, Vaka II Palvelut), Dr Jane Thostrup Jagd (Deputy Director, We Mean Business Coalition, Net Zero Finance), Svante Forsberg (Chair, Swedish Academy of Board Directors) and Christine Ehnström (Head GRC Advisory & CEO, FCG Risk & Compliance) shared their insights facilitated by moderator Cecilia Widebäck West, Operations Director at Boards Impact Forum.

Many new legislative activities are changing the landscape for investors, financial services providers, and corporates. This can be overwhelming for many. Access to capital is critical to ensure that the transformation happens and goes faster. Thereby investors and other financial providers are put at the forefront of the change.

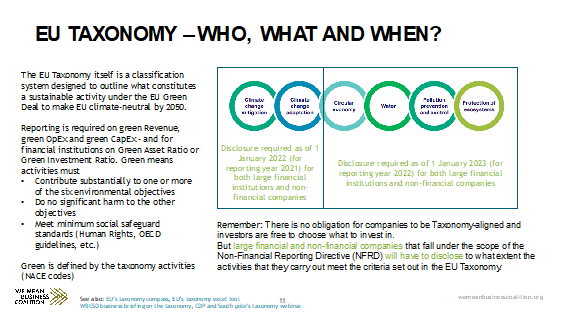

Currently, the sustainability reporting done by companies is quite varied, making it hard for investors to compare data. There are also many sustainability frameworks in the market that companies can follow (SASB, GRI, TCFD etc), which is sometimes referred to as an alphabet soup. To bridge this gap, the International Sustainability Standards Board (ISSB), under IFRS, harmonizes sustainability data reporting standards to enable comparison on the same efficiency as financial data. In the meantime, large financial institutions and non-financial companies must assess their existing approaches against the EU Taxonomy and explain these assessments to both their board and the financial market. Worth noting is that there is no obligation for financial or non-financial companies to align with the EU Taxonomy. Still, there is an obligation to report and disclose the degree of alignment.

From 1st January 2022, most financial companies and most non-financial medium and large companies will have to start to report based on the new EU Taxonomy. Moving further into 2022, the International Sustainability Standards Board (ISSB) will release its new global standards with minimum requirements and sector-specific KPIs. Next year, in 2023, the EU’s Corporate Sustainability Reporting Directive (CSRD) will come into force and will be binding for even more companies. Finally, the European Single Access Point (ESAP), a new database of ESG data derived from all companies reporting against CSRD.

This new legislation and the increased focus on ESG by supervisory authorities put significant pressure on financial services companies. They are expected to take a strategic view on ESG, improve ESG knowledge and skills, and integrate ESG into the corporate culture. Naturally, risk management needs to integrate ESG and transform the risks into financial risks. In addition, they are expected to take a longer horizon – at least ten years.

“Reporting used to be on what you have done, but with ESG, it is the reporting on the future that will force financial services to take actions.” – Christine Ehnström

Investors are looking for clarity and comparability of ESG information. Initially, investors will have to report on their portfolios, even before the portfolio companies have started to report themselves.. The different timelines, investors reporting first, companies starting reporting later, and the reporting standard coming into effect even later, mean that the detailed practices and clarity could take 1-2 years to be established. The process will evolve, and it was recommended to collaborate amongst stakeholders and start with a more limited reporting scope.

Table of Contents

Impact on Boards

With new and increased legislation, there is a risk that boards will mainly focus on compliance and reporting. Boards need to take a broader approach while still taking reporting requirements seriously. Sustainability is a business issue, and the board needs to start with the business and its risks and opportunities. Determine the ambition, and then decide on the strategy and transition plan, which investors will require. Specifically, the integration of sustainability into the overall business strategy and board-level discussions is vital to success. Board members themselves need to understand the sustainability issues.

“ESG is a business issue, so treat it like that and not just a reporting issue” – Harri-Pekka Kaukkonen

ESG reporting is challenging for most companies and boards. The aim is to have the same quality for the ESG data as for the financial data, which will entail step-by-step learning. The quality is not fully there yet for most companies, and the audit committee will play a pivotal role in guiding that. To improve further, take advice from your auditors, collaborate with others, talk about the roadmap, and discuss the difficulties.

“The CEO should be in the driver’s seat of sustainability integration for the company” – Svante Forsberg

Practical ESG Reporting Tips

To begin with, extend the internal control set-up and reporting of ESG to the audit committee to solidify confidence in both: evidence of data across the entire organization and the external assurance process. Moreover, ensure external assurance on ESG data, for example, through your existing financial auditor and financial consolidation system. In doing so, coherence and comparison between financial and ESG data can be established. Finally, if your company has no assurance to date, start with a limited level, still following the regulation, then advance to the reasonable level. As this will be a requirement for the upcoming EU CSRD obligations in January 2023, it is best to act now.

“A good collaboration between ESG professionals and financial professionals is enormously important to get the data right.” Dr Jane Thostrup Jagd

Key Considerations for Boards

- Step-by-step – start small, conceptualize your ambitions in terms of strategy first. Understand that you cannot satisfy all stakeholders.

- Take a top-down approach. The CEO and the Board must make strategic ESG decisions and actions.

- Look inward – does your company have sufficient knowledge and skills about ESG risks and opportunities? Do you efficiently manage third-party risks? How does ESG fit into the company culture and strategic agenda?

- Educate – request auditors to advise and support the assessment and ascertain the reporting (even if detailed requirements are not yet in place). Ensure to train the board to gain a comprehensive understanding of the implications of the ESG journey.

- Collaborate with other companies and stakeholders and internally between the Sustainability, Finance, Risk, and Business Development departments. A holistic approach is key to achieving high-quality results and data and reporting.

- Measure – establish meaningful KPIs and track with continuity at the board level.

- Tell the truth – don’t be too optimistic about the company’s roadmap for the future. Honesty is essential for progress.

- Be an opportunist – the customer demand for ESG and industry-specific changes can be a boost instead of a burden!

To learn more and join Boards Impact Forum

The full presentation from the event can be found here

The recording from the webinar can be found here

Upcoming webinars at Boards Impact Forum Our Events – Boards Impact Forum

Joining as a member or to receive the newsletter Join the Forum – Boards Impact Forum

Blogpost written with support of Annachiara Torciano, Prime Weber Shandwick

Recent Comments