On the 16th of February we had the third session from the program “Board Oversight of Sustainability for Value Creation”, where we discussed Board Dilemmas around: Aligning Sustainability Strategy, Regulatory Compliance and Incentives.

The guest speakers where:

- Denise Koopmans, NED Sanoma & Chair Audit Com, NED Royal BAM Group & Chair Remco, NED Swiss Post & Chair Investment Com, NED Cicor & Chair Audit com, NED Norma Group will share Boards role in aligning strategy, defining and disclosure of ESG measures

- Frederic Barge, CEO Reward Value, Former KPMG Pattern and HR Executive at Large Organisations will share his insights on remuneration and guidebook launched by them at the recent WEF Davos event.

- Dr Jane Thostrup Jagd, Director, Net Zero Finance at We Mean Business Coalition, Member SBTi Advisory Group, EFRAGs ESRS Listed SME Community, ISSB Advisory Group, Nasdaq Sustainable Financings Nordic Advisory Group will share her insights from the reporting and its impact.

- Facilitation by Liselotte Engstam, Chair Boards Impact Forum and chair and NED at listed and private companies.

Denise Koopmans started by sharing her thoughts on the role of the board in setting strategy and that ESG should be at the core of the way companies do business. Denise sees that companies are integrating more and more ESG, although some companies are still lagging. To address this boards need to operate as corporate citizens and under regulatory frames. In this context companies should pay attention to the latest examples of litigation from NGOs towards companies. Sometimes businesses have to deal with competing ESG demands and competing demands from different NGOs, some addressing social challenges, some addressing climate change, etc.

Denise followed by completing that boards need to set KPIs, connected to remuneration but connected to the interests of stakeholders. This groups of stakeholders has dramatically extended and grow, making this process more challenging. The KPI should be material for the business and both financial and non-financial, as well as inspirational to set the culture and spirit. Sustainability peers are also importance, so you can compare and get inspired.

There is a debate around setting remuneration related to ESG KPIs, someone said “You should not be paid for doing the right things”, but Denise defends that is important to have a connection from KPIs and remuneration. In this area, the flexibility and space for the board has been narrowing.

An example brought by Denise was that, in one of the boards that she sits on, they had a collaboration with the NGO “Friends of the Earth” that looked at the organization and challenged the board into taking new and more ambitious directions.

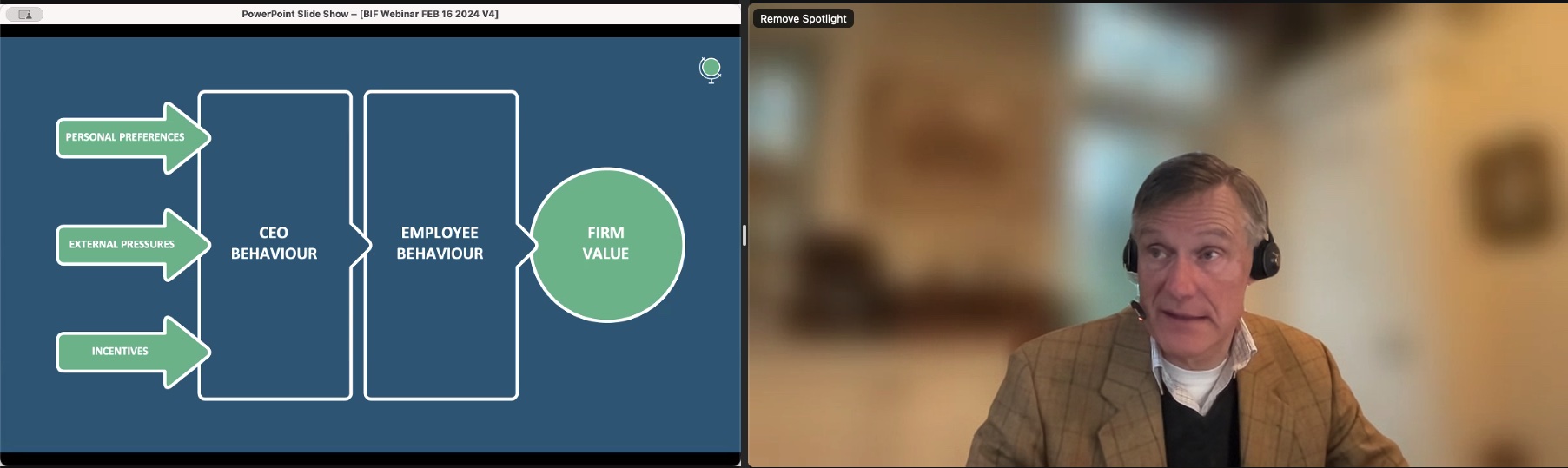

The following presentation had Fredric Barge as the speaker, who started presenting his organization Reward Value Foundation. Fredric made the point that the businesses with a long-term perspective have better results and presented remuneration as a lever to guide corporate behavior, based on experiments driven by the Reward Value Foundation.

Fredric presented is that both intrinsic and extrinsic motivation and pressure is important:

- Attract and retain quality leaders – fixed pay

- Attract and retain long-term value creation – fixed pay + restricted stock

- Attract and retain Sustainable long-term value creation and transition – fixed pay + performance based incentives

Furthermore, Fredric pointed out that executive remuneration is the truest expression of a corporation’s real priorities. He then followed with an overview of the remuneration assessment tool, looking into Purpose, Practice, Pay and Performance, and diving more in-depth on all points.

As an example, Fredric presented Shell’s Fixed pay and shareholding, Annual bonus and Long-term incentive plan. He pointed out that to ensure new behaviors were created, there should be enough weight into the long-term targets (for example 14% at Shell), compared to the relatively small impact from short-term incentives. Be bold and check if there is relevance, if they are sufficient to the executive team.

Finally, Fredric presented and explain the concept of corporate citizenship, looking at the stakeholders (regulatory, financial, operational, relational) and policy tools (discretion, malus and claw back). A good tip is to invite stakeholders in groups, so to allow stakeholders to listen to each other.

The final presentation come from Jane Thostrup Jagd, who addresses what is already happening such as the Green taxonomy, and what is yet coming.

Looking into the Green Taxonomy, Jane reported that she thinks it is very complex and that the law is not well made. It needs to be simplified and some terms should be more clear, this would make it easier to implement for businesses. From a company perspective, the taxonomy should be seen as a way to raise capital. This would fight the ESG lack lash and allow businesses to issue green bonds for specific initiatives, allowing “black” businesses to raise capital for the transformation. This is why this is important, it will allow companies to be found by investors on their green initiatives.

On the topic of what is coming up, Jane pointed out that the CSRD will hit all listed and private companies, as well as the outside of EU businesses that are part of the value chain. Moving forward also listed SME’s will also need to report. The corner stone is double materiality, identify what is material and report only on those (not the total of 11.000 reporting points!). To clarify, it is not only the intersection between impact and financial materiality, but rather both, even if they don’t intersect.

The double materiality assessment (DMA) should furthermore impact on the risk mapping, the policies and targets organizations have.

The participants then answer a pool which selected the dilemma to be discussed at the break-out rooms.

After the discussion and peer exchanges in groups, all the participants convened back and share the discussions, and the panel of speakers gave their answers to the questions raised.

Fredric pointed out that businesses should be careful, focus on material topics and give it meaning. There is a decision to select the right topics, mostly on the sectors when they have a lot of environmental challenges. Some industries, for example pharma, has very long time KPIs for CEOs. Fredric thinks is a balance between the materiality and the short-term and long-term incentive. Fredric pointed out that we should see this as a process and that businesses need to build experience and learn on how to build the KPIs.

Jane addressed green washing and used bank as an example. For example, Morning star is talking to move towards action and this is driven by taxonomy, because investors have this overview. Jane also pointed out that soon there will be a social taxonomy. The Green claims directive is a different game, aimed at what you say to your customers, businesses should be careful with how they appraise themselves and marketing themselves at the same time.

Recent Comments